Single & Multi Family Office

Different banks, illiquid assets. Everything in one single platform.

REQUEST A DEMO

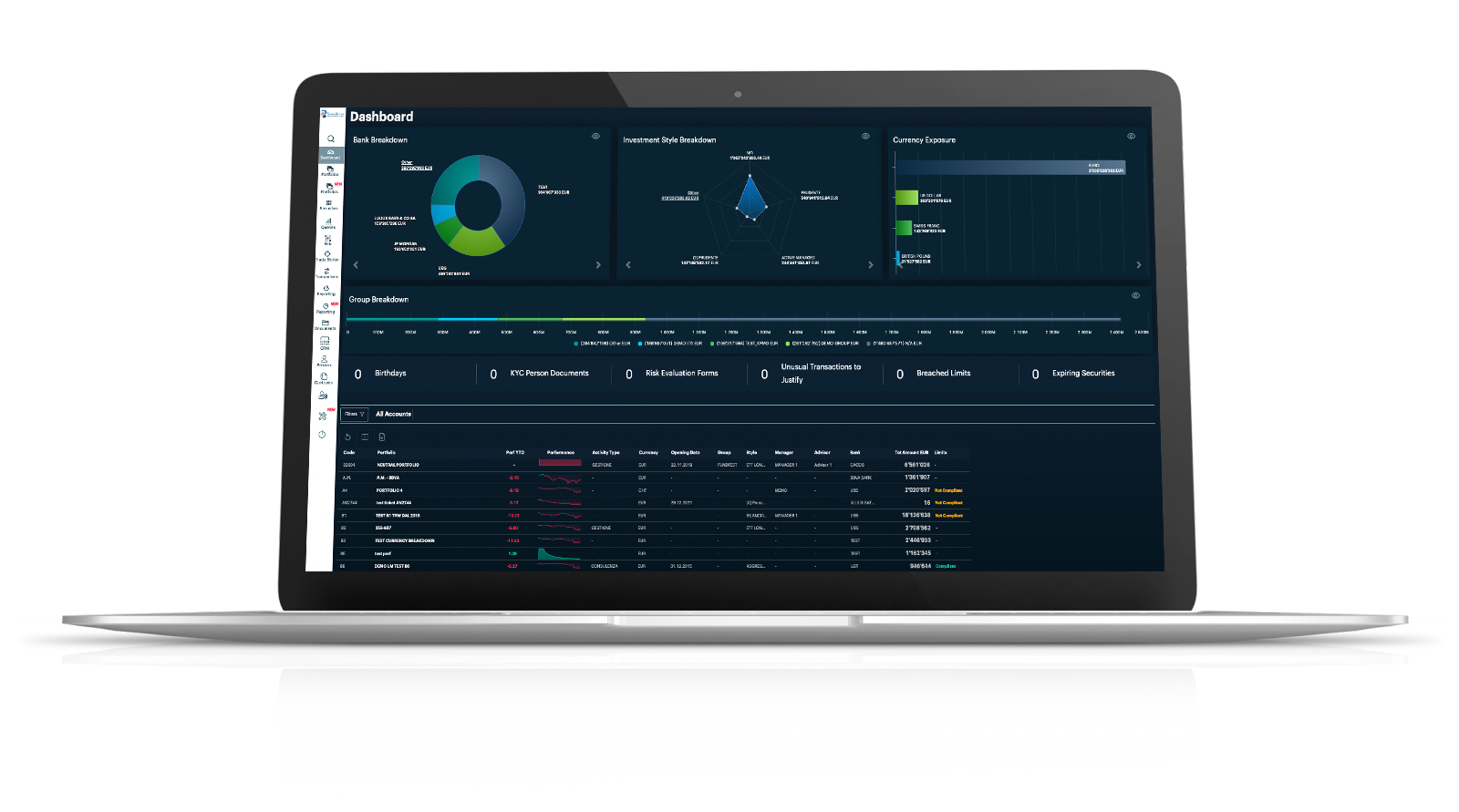

A single software that allows you to consolidate, manage and monitor all your portfolios on different custodian banks in a completely automated way, with a web interface dedicated to your clients or family members for consulting their global assets.

Key benefits

for

Single & Multi Family Office

Valuable modules

for

Single & Multi Family Office

Portfolio Management

Advanced functions and tools to support the managers and advisors’ analyses and activities, with an intuitive, high-performance interface with depth of information.

Automatic connections with more than 60 custodian banks

Daily automatic receipt of positions and transactions booked by custodian banks for all your portfolios.

Assets consolidation

Consolidate and supervise all your clients' portfolios on different custodian banks, including non-financial assets.

Back Office & Administration

The highest level of digitization and automation for your administrative team

Know Your Client, Anti-Money Laundering & Customer Relationship Management

Organise and digitise all your clients' data and documents

Report Generator

In addition to the various standard reports made available, possibility of generating completely customised reports in terms of graphics and content.

Web App dedicated to family members

Web portal specifically developed to give access to family office clients, through a clear and functional interface, where the clients can consult the various information relating to their portfolios, including consolidated ones.

Dedicated Web App for managers and consultants

Web access dedicated to managers, consultants and end clients, through application for smartphones, tablets and PC

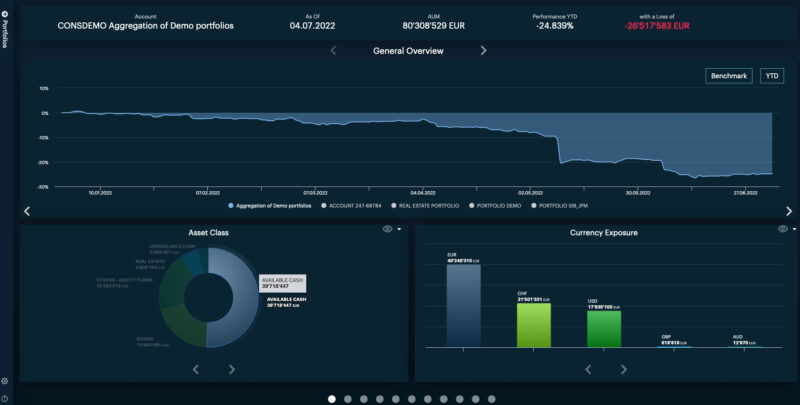

Portfolio Management

Advanced functions for management, analysis and monitoring of portfolio allocation and risk, asset consolidation, performance contribution and attribution: these are just some of the functions to support your management team.

Automated creation of an unmodifiable PDF document containing the order and pre-compliance Log for each operation recorded in the system.

Automatic connections with more than 60 custodian banks

Your Guardian Server will receive in a fully automated way the flows of the various custodian banks containing all the transactions and official positions of your clients’ T-1 portfolios, in order to verify what has been booked and keep the position of all your clients updated.

What if your custodian banks are not in the list?

No problem. Every year we create new banking connections for our clients, having a dedicated team that in a few weeks is able to develop the new banking interface required. In any case, with Guardian you can manage portfolios even without having an automatic connection with your custodian by entering the transactions manually.

UBS, Julius Baer, Credit Suisse, EFG, LGT, Lombard Odier, Corner Bank, Rothschild Luxembourg, Dexia Bank, Royal bank of Canada, Pictet, Goldman Sachs, Jp Morgan, Morgan Stanley, Banque De Groof Luxembourg, KBS, Banca Stato,Caceis, Compagnie Monegasque de Banque (CMB), Banca Zarattini, Bank of Valletta, , Banca Leonardo, Banca Sella, Banca Arner, One Swiss Bank, BIL Luxembourg, Credit Agricole, Axion, Banca Euromobiliare, BNL, Bnp Paribas, Banca CIC, Banca Finnat, Banca Ifigest, Deutsche Bank, Northen & Trust, Intesa San Paolo, J Safra, LGT, Mediobanca, Aquila bank,VP bank, Zurcher Kantonal bank,Basler Kantonal Bank, St Galler Kantonal Bank, Marki & Baumann

Assets consolidation

Possibility of consolidating in the client’s total assets, in addition to financial securities, real estate, private equity, artworks and industrial investments, to provide to the clients an accurate analysis of total wealth with reporting and dedicated web interface.

Back Office & Administration

Complete digitization of all operations for the highest level of automation and efficiency to process and verify all operations, fees and debits received from the bank. Automated integration with corporate accounting systems.

Back office full outsourcing service

Our clients have the possibility to completely outsource the back office activity to Swiss-Rev SA, so as to guarantee the timely import and reconciliation of all portfolios to the family office on a daily basis. You will focus solely and exclusively on the analysis and management of portfolios, while we will take care of everything else.

Once the consolidated portfolio has been created, Guardian will independently calculate the consolidated position and the MWR or TWR performance on a daily basis.

Know Your Client, Anti-Money Laundering & Customer Relationship Management

The Know Your Client module is a digital encrypted repository that guarantees the highest protection of information and documents contained. By this way, your contracts with clients are in a safe place and fully integrated into the platform.

Web-based customer onboarding module that guides the consultant in uploading all client and contract data, up to the signing of the profiling questionnaires, which can be digitally signed by the client.

All sensitive data is stored in a separate and fully encrypted database.

Possibility of profiling access and related authorizations to the personal data management section for specific users only.

All personal data changes are traced in order to faithfully reconstruct all the changes made over time, and all sensitive data is saved in a special encrypted database.

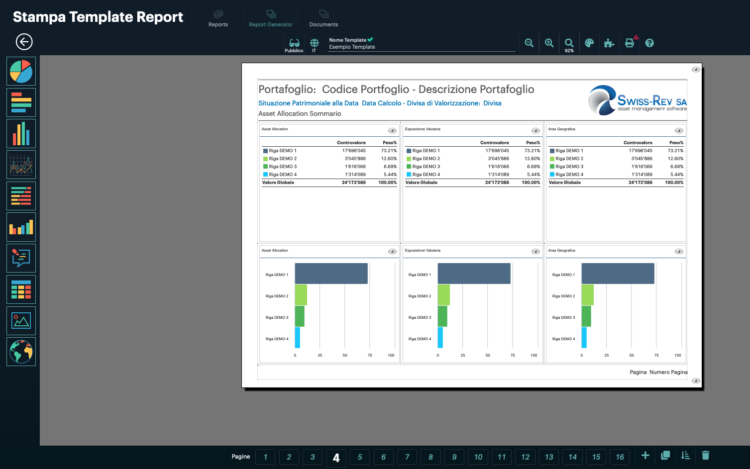

Report Generator

Wide range of Reports available to the user, such as performance contribution reports, account reoirts, market overviews, fund factsheets. All these reports are generated automatically and they can be sent to a mailing list up to five different languages, with the possibility to customize them according to specific needs.

Report generator module that allows you to create infinite templates and for each of them define the graphic layout and contents with maximum autonomy.

Dedicated Web App for managers and consultants

The Guardian Web platform allows the front office users (managers, promoters, consultants) and end customers to connect and operate in real time from anywhere in the world, with any mobile device.

Guardian Web Demo