Asset & Wealth Managers

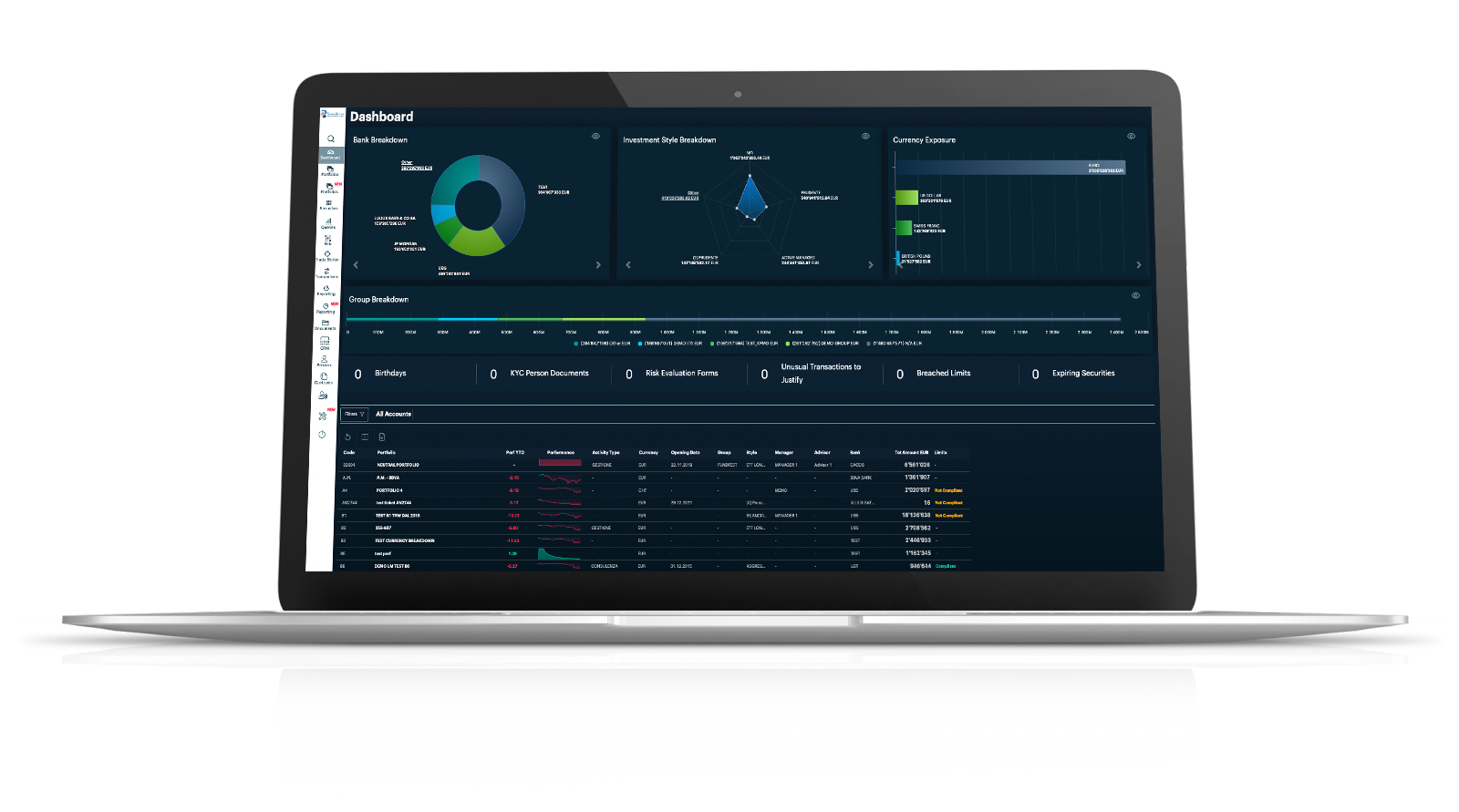

A global platform covering all the key activities in Asset and Wealth Management.

REQUEST A DEMO

Portfolio management on various custodian banks, advanced portfolio management functions supporting the management team, order routing, automated functions supporting back & middle office, risk management, compliance & reporting, CRM, KYC management and report generator. This is Guardian software.

Key benefits

for

Asset & Wealth Managers

Valuable modules

for

Asset & Wealth Managers

Portfolio Management

Advanced functions and tools to support the asset managers’ analyses and activities.

Automatic connections with more than 60 custodian banks

Automatic receipt of positions and transactions settled by the custodian banks for all your portfolios.

Order Routing

Trading in equities, bonds and derivatives with any broker in the world, via FIX or other protocol, for the maximum security and speed of execution.

Risk Management & Compliance

Real-time checks on all regulatory and discretionary limits for your portfolios, with several analytical tools.

Back & Middle office

Complete digitization of all operations for the highest level of automation and efficiency.

Know Your Client, Anti-Money Laundering & CRM

Organize and digitise all your clients' data and documents.

Fees, Invoicing & Profitability

Automatic calculation of management and performance fees, invoce generations and Return on assets (ROA) analysis for all your portoflios.

Report Generator

In addition to the several standard reports available, it is possible to generate completely customised reports in graphic form and content.

Web App for managers, advisors and end-users

Web access dedicated to portfolio managers, financial advisors and HNWI through an app for smartphones and tablets.

Portfolio Management

Advanced portfolio management functions, massive order simulations, rebalancing with model portfolios, asset consolidation, performance contribution and attribution: these are just some of the functions supporting your management team.

Once the consolidated portfolio has been created, Guardian will independently calculate the consolidated position and MWR or TWR performance on a daily basis.

Automatic connections with more than 60 custodian banks

No manual input: everyday you will automatically receive on your server trade confirmations and official positions of all your portfolios in T-1. This is going to boost efficiency in matching operations and updating your portfolios.

What if your custodian banks are not in the list?

No problem. Every year we create new interfaces at the client’s request. One of our strengths is the ability to create a new interface via FIX, SWIFT, or other protocols in a few weeks. Of course, with Guardian you can manage the portfolios for which there is no interface with the custodian bank, by entering trades manually.

UBS, Julius Baer, Credit Suisse, EFG, LGT, Lombard Odier, Corner Bank, Rothschild Luxembourg, Dexia Bank, Royal bank of Canada, Pictet, Goldman Sachs, Jp Morgan, Morgan Stanley, Banque De Groof Luxembourg, KBS, Banca Stato,Caceis, Compagnie Monegasque de Banque (CMB), Banca Zarattini, Bank of Valletta, , Banca Leonardo, Banca Sella, Banca Arner, One Swiss Bank, BIL Luxembourg, Credit Agricole, Axion, Banca Euromobiliare, BNL, Bnp Paribas, Banca CIC, Banca Finnat, Banca Ifigest, Deutsche Bank, Northen & Trust, Intesa San Paolo, J Safra, LGT, Mediobanca, Aquila bank,VP bank, Zurcher Kantonal bank,Basler Kantonal Bank, St Galler Kantonal Bank, Marki & Baumann

Order Routing

Sending orders directly to intermediaries via FIX or alternative protocols, to ensure maximum efficiency and speed of execution.

Orders are sent electronically to your brokers through Bloomberg EMSX/TSOX platform or specific connections by FIX, SWIFT, XML or other protocols.

With Guardian Fix Blotter you can place single orders or orders for groups of portfolios and send them electronically to the counterpart, receiving the order execution status in real time. Ability to specify specific time and price parameters for each broker, as well as automatic calculation of trading fees. Possibility of automatically receiving trades in real time from brokers through automatic flows, via Bloomberg Chat or terminal, thanks to the interface with Bloomberg Dropcopy.

Guardian is an official Bloomberg EMSX Staging, EMSX Net and TSOX certified software. Algorithmic trading strategies have also been developed on the basis of specific requests from some clients to allow the automatic sending of orders to the market according to the set quantitative logic, ensuring low latency and maximum efficiency.

Some of our interfaced brokers:

Bloomberg EMSX · Credit Suisse · UBS · Goldman Sachs · JP Morgan · Banca Sella · CA Indosuez · Société Générale · Intermonte

Risk Management & Compliance

Possibility for the user to set any type of limit to ensure the maximum level of security for all transactions entered and to monitor exposure to each limit in real time, even in the event of a passive breach.

- regulatory (deriving from regulation and required by the banking and financial authorities)

- mandatory (deriving from the management/advisory mandate signed with your clients, compliant to their investment risk profile)

- discretionary (they come from the investment decisions made by your board, even temporary, they can be non-blocking rules)

interpolating many parameters such as asset class, issuer, market, country, rating, duration, Suitability and Appropriateness profile of your clients, etc. Opportunity to create alerts (warnings) in case of approaching the limits already set, according to an editable tolerance range.

If the transaction is compliant, it will be listed into the Guardian Trade Blotter where you can monitor its status while you wait for the bank’s execution. Advanced post-Compliance elaborations and several key risk indicators such as the portfolio VaR are available too.

Back & Middle office

Complete digitalization of all operational processes to ensure the highest level of automation, efficiency and quality of work.

For each portfolio, automatic generation of trades relating to dividends, coupons, redemptions, corporate actions, option exercises according to market specifications (cash delivery, future delivery, out/in the money).

Once the consolidated portfolio has been created, Guardian will independently calculate the consolidated position and MWR or TWR performance on a daily basis.

Know Your Client, Anti-Money Laundering & CRM

Fully digitised management of subject and contract data, to ensure an easy insertion and search of any data or document of a client.

Client onboarding module via web that guides the consultant in uploading all client and contract data, up to the signing of the profiling questionnaires, which can be digitally signed by the client.

All personal data are on a separate and fully encrypted database.

Ability to profile access and related permissions to the personal data management section for specific users only.

All personal data changes are tracked in order to faithfully reconstruct all the changes made over time.

Fees, Invoicing & Profitability

Fully automated calculation of management and performance fees for each portfolio, using various configuration parameters.

Once set, Guardian will generate the invoice for each portfolio at the defined deadline. Report dedicated to the analysis of the profitability of portfolios.

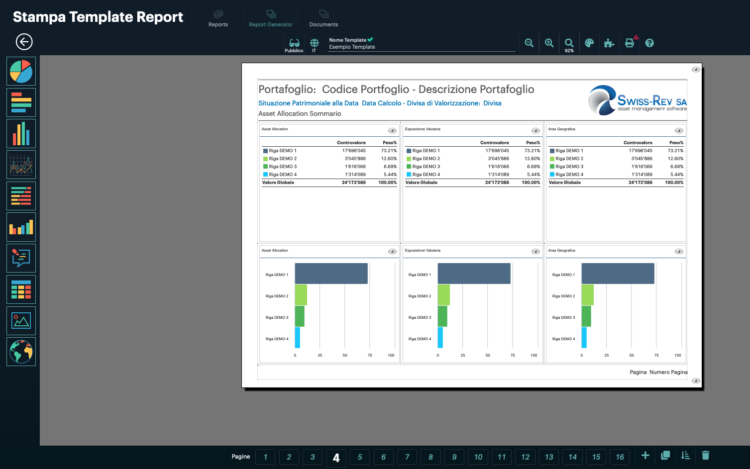

Report Generator

Wide choice of standard reports available including performance contribution reports, portfolio analysis, management reports or risk analysis reports.

Report generator module that allows you to create infinite templates and define graphic layouts and contents with maximum autonomy.

Web App for managers, advisors and end-users

Guardian Web allows the Front Office users (portfolio managers, promoters and advisors) and the end-clients to connect and use in real-time the software from anywhere in the world, with any kind of mobile device.

Guardian Web Demo