Funds, SICAVs and Management Companies

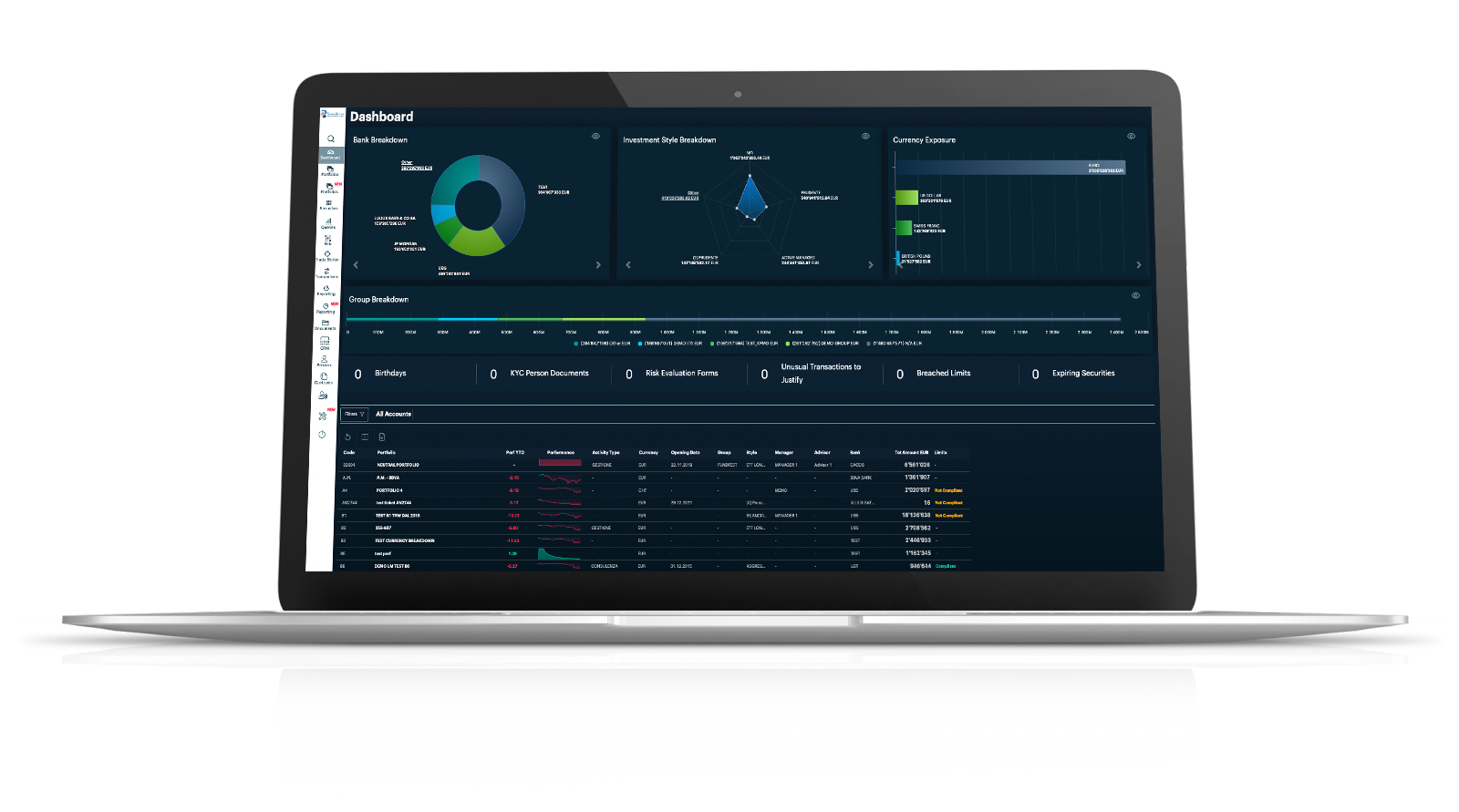

A single platform for portfolio & risk management, back & middle office, order management and reporting of your SICAV funds

REQUEST A DEMO

An integrated platform that allows you to achieve maximum automation of operational processes, from fund management with advanced portfolio management functions, to the pre-compliance validation of all transactions entered, up to the total automation of back & middle office processes or to the automated generation of factsheets or reports. This is Guardian software.

Key benefits

for

Funds, SICAVs and Management Companies

Valuable modules

for

Funds, SICAVs and Management Companies

Portfolio Management

Advanced functions and tools to support the fund managers’ analyses and activities

Automatic connections with more than 60 custodian banks and Fund Administrators

Automatic receipt of the NAV and of the settled transactions from the custodian banks and Fund Administrators for all your funds

Order Routing

Trading in equities, bonds and derivatives with any broker in the world, via FIX or other protocol, for the maximum security and speed of execution

Risk Management

Real-time checks of all regulatory, prospectus or discretionary limits set on your portfolios, with detailed pre and post compliance reports for portfolio risk analysis.

Back & Middle Office

The highest level of digitization and automation for your operations team

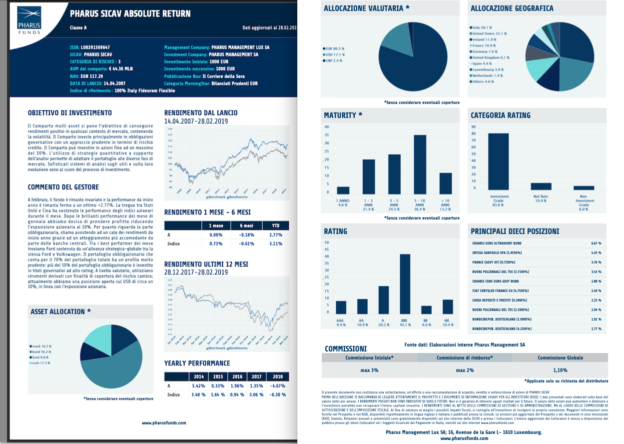

Automatic Reporting

Factsheets, monthly letters and several other reports automatically generated, available in different languages

Web App for fund managers

Web access dedicated to fund managers and advisors through an app for smartphones and tablets

Configuration dedicated to Management Companies

Let's digitize the entire service from ManCo, from the real-time connection of the various managers or advisors, to the pre-compliance validation of the orders entered in the system, up to the generation of automated post-compliance reports in accordance with the requirements of the Luxembourg CSSF or the Maltese MFSA.

Portfolio Management

Real-time NAV calculation, maximum flexibility in portfolio classification on N levels, performance contribution and attribution analysis, asset allocation evolution and specific portfolio risk analysis reports: these are just some of the functions supporting portfolio managers.

Automated creation of an unmodifiable PDF document containing the order and pre-compliance Log for each operation recorded in the system.

Automatic connections with more than 60 custodian banks and Fund Administrators

No manual input, because you will automatically receive everyday, or periodically depending on the kind of funds, trade confirmations, official positions and NAV of all your funds from the custodian banks and Fund Administrators, directly on your server. This is going to boost efficiency in matching operations and make cost controlling very easy.

What if your custodian banks or Fund Administrators are not in the list?

No problem. Every year we create new interfaces at the client’s request. One of our strengths is the ability to create a new interface via FIX, SWIFT, or other protocols in just 15 days. Of course, with Guardian you can manage the portfolios for which there is no interface with the custodian bank by entering the trades manually.

UBS, Julius Baer, Credit Suisse, EFG, LGT, Lombard Odier, Corner Bank,Vontobel Bank, Rothschild Luxembourg, Dexia Bank, Royal bank of Canada, Pictet, Goldman Sachs, Jp Morgan, Morgan Stanley, Banque De Groof Luxembourg, State Street, Apex, KBS, Banca Stato, Caceis, Compagnie Monegasque de Banque (CMB), Banca Zarattini, Bank of Valletta, Calamatta & Cuschieri, Banca Sella, Banca Arner, One Swiss Bank, BIL Luxembourg, Credit Agricole, Axion, Banca Euromobiliare, BNL, Bnp Paribas, Banca CIC, Banca Finnat, Banca Ifigest, Deutsche Bank, Northen & Trust, Intesa San Paolo, J Safra, LGT, Mediobanca, Aquila bank,VP bank, Zurcher Kantonal bank,Basler Kantonal Bank, St Galler Kantonal Bank, Marki & Baumann, Wells Fargo, European Fund Administration, Amicorp.

Order Routing

Sending of orders directly to intermediaries via FIX or alternative protocols, to ensure maximum efficiency and speed of execution.

Send buy and sell orders electronically to your market counterparties through Bloomberg EMSX/TSOX or with dedicated point-to-point connections, via FIX or alternative protocols (SWIFT, XML, etc.)

With Guardian Fix Blotter you can enter single orders or for groups of portfolios and send them electronically to the counterparty, receiving the order execution status in real time. Ability to specify time and price parameters specific to each broker, as well as automatic calculation of trading commissions. Possibility to automatically receive real-time trades from brokers through automatic flows, via Bloomberg Chat or terminal, thanks to the interface with Bloomberg Dropcopy.

Guardian is an official Bloomberg EMSX Staging, EMSX Net and TSOX certified software. Algorithmic trading strategies have been developed for some clients, based on the client’s specifications, to allow the automatic submission of trades to the market in response to quantitative signals generated by the strategy, guaranteeing low latency and maximum efficiency.

Some of our interfaced brokers:

Bloomberg EMSX · Credit Suisse · UBS · Julius Baer · Goldman Sachs · JP Morgan · Banca Sella · CA Indosuez · Société Générale · Intermonte · State Street

Risk Management

We know that monitoring the risks of your funds is very important for you: that is why in Guardian you can set any kind of limit you want on your funds, and monitor the real-time exposure in order to avoid breaches.

Opportunity to create alerts (warnings) in case of approaching the limits already set, according to an editable tolerance range.

For each operation, generation of an unmodifiable PDF document which summarises what was reported to the user, as well as checking each limit with all the securities considered in the calculation.

Back & Middle Office

Complete digitization of all operational processes to ensure the highest level of automation, efficiency and work quality.

Automatic generation for each portfolio of trades relating to ex-dividends, coupons, redemptions, corporate transactions.

Automatic generation of options and derivatives exercise based on the characteristics of the instrument (cash delivery, future delivery, out/in the money).

Automatic sending of the settlement instruction (SSI) to each counterparty with the automated generation of the required file complete with all the required settlement fields.

Automatic Reporting

Wide range of Reports available to the user, such as performance contribution reports, newsletters, market overviews, fund factsheets. All these reports are generated automatically and they can be sent to a mailing list up to five different languages, with the possibility to customize them according to specific needs.

Web App for fund managers

Guardian Web allows the Front Office users (investment managers and advisors of funds, even delegated) to connect and use in real-time the software from anywhere in the world, with any kind of mobile device.

Guardian Web Demo

Configuration dedicated to Management Companies

For each manager/user, it is possible to set different levels of permission and/or configuration of the management of non-compliant orders (blocker, sending of the authorization request to ManCo or another user, etc.).