Italian SIMs and SGRs

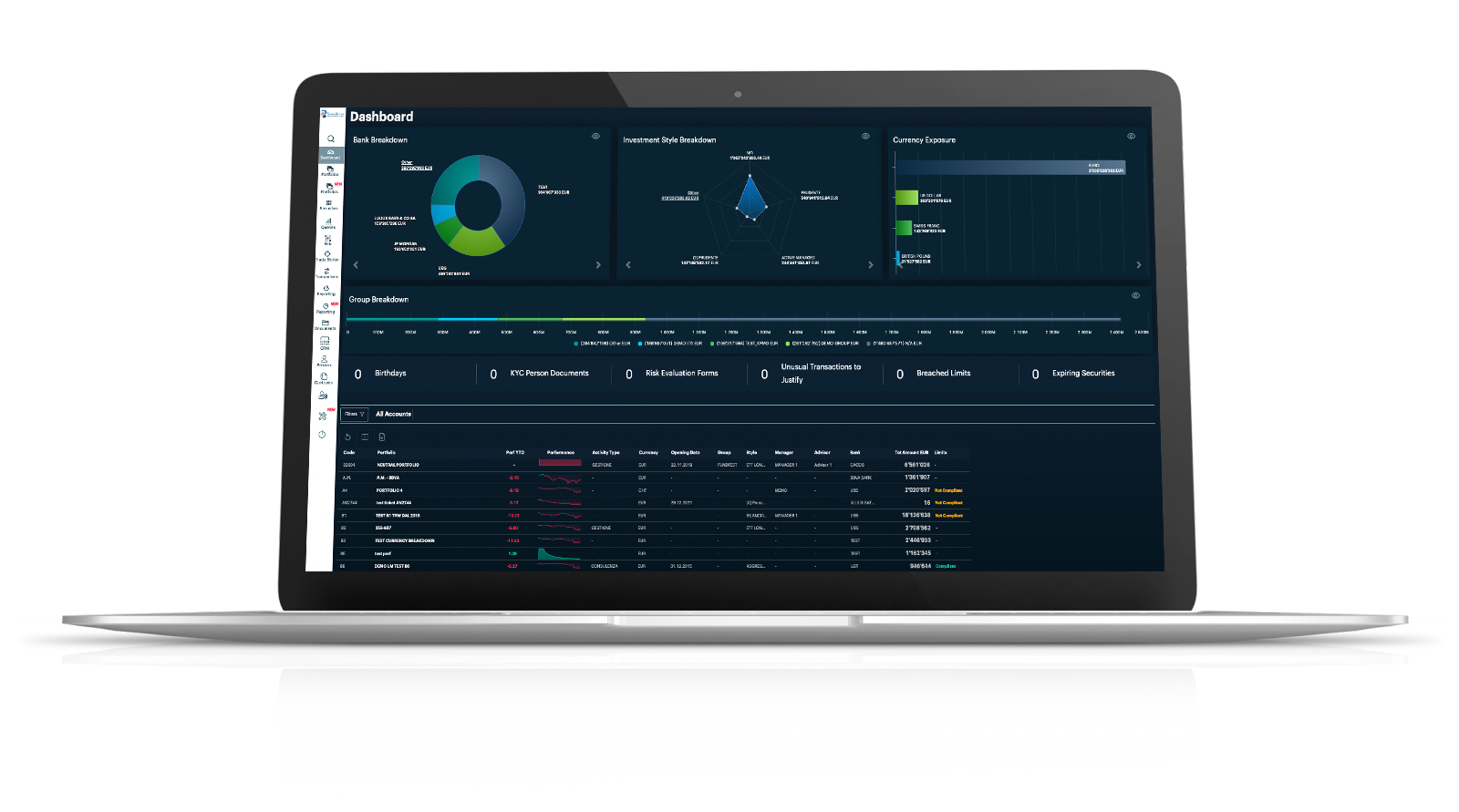

A global platform covering all the key activities in Asset and Wealth Management.

REQUEST A DEMO

Guardian software supports all operational areas of a SIM or Italian SGR to offer maximum efficiency and automation of all the main operational processes of your management company.

Key benefits

for

Italian SIMs and SGRs

Valuable modules

for

Italian SIMs and SGRs

Portfolio Management

Advanced functions and tools to support the asset managers' and wealth advisors' analyses and activities

Automatic connections with more than 60 custodian banks

Automatic receipt of positions and transactions settled by the custodian banks for all your portfolios and of the NAV of all your funds.

Financial advice

Massive and automated generation and sending of recommendations to your clients in three simple steps.

Order Routing

With Guardian FIX Blotter you can trade in stocks, bonds, options, futures, CFDs and FX with any broker in the world.

Risk Management & Compliance

Real-time checks on all regulatory and discretionary limits for your portfolios, with several analytical tools.

Back/Middle Office & Operations

Complete digitization of all operations for the highest level of automation and efficiency.

Notifications to the Supervisory and Tax Authorities

Automated processing of mandatory notifications to Consob, Bank of Italy, Tax Registry and AUI reports, and automated calculation of taxation according to the different regimes.

Registry management & Customer Relationship Management

Digital management of all information and documents relating to your clients and contracts.

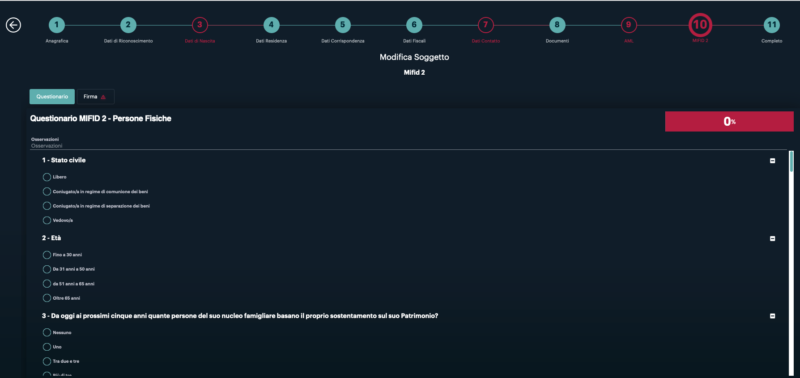

Digital onboarding of master data and contracts

Fully digital by web wizard, which guides the consultant in entering all personal data and contract information, including the digital signature of the profiling questionnaires and the mandate signed by the client.

Fees, Invoicing & Profitability

Automatic calculation of any kind of fee and automatic invoicing, with cost control tools and detailed profitability analysis.

Automatic Reporting and Report Generator

Wide range of reports available in different languages, automatically created and sent by email to your mailing lists

Web App for managers, advisors and end-users

Web access dedicated to portfolio managers, financial advisors and HNWI through an app for smartphones and tablets.

Portfolio Management

Position keeping, account consolidation, performance analysis, simulations, financial advice: these are only a few features you can use to effectively manage your portfolios.

Once the consolidated portfolio has been created, Guardian will independently calculate the consolidated position and MWR or TWR performance on a daily basis.

Order log automatically fed with all the details required by the regulator.

Automatic connections with more than 60 custodian banks

Daily automatic receipt of positions and transactions booked by custodian banks for all your portfolios.

What if your custodian banks are not in the list?

No problem. Every year we create new interfaces at the customers’ request. One of our strengths is the ability to create a new interface via FIX, SWIFT, or other protocols in just 15 days. Of course, with Guardian you can manage and add to portfolios for which there is no interface with the custodian bank, by entering trades manually.

Financial advice

Automatically generate and send consultancy recommendations to all your clients, via email, PEC or via notifications on their smartphone, with the details of the ex-ante costs and the KIIDs/KIDs of the recommended securities and automatically attached to the email sent to the client, in a way that is totally compliant with the MiFiD II regulation. Automatic generation and sending of consultancy reports to be sent to clients, divided into different sections of analysis and summary of the recommendations sent in the period.

of Consultancy Report

Order Routing

Sending of orders directly to intermediaries by FIX or alternative protocols, to ensure maximum efficiency and speed of execution.

Orders are sent electronically to your brokers through Bloomberg EMSX/TSOX platform or specific connections by FIX, SWIFT, XML or other protocols, and they include price, date, quantity and all the main parameters of the order.

With Guardian Fix Blotter you can enter single orders or for groups of portfolios and send them electronically to the counterparty, receiving the order execution status in real time. Ability to specify time and price parameters specific to each broker, as well as automatic calculation of trading fees. Possibility to automatically receive real-time trades from brokers through automatic flows, via Bloomberg Chat or terminal, thanks to the interface with Bloomberg Dropcopy.

Guardian is an official Bloomberg EMSX Staging, EMSX Net and TSOX certified software. Algorithmic trading strategies have been developed for some clients, based on the client’s specifications, to allow the automatic submission of trades to the market in response to quantitative signals generated by the strategy, guaranteeing low latency and maximum efficiency.

Some of our interfaced brokers:

Bloomberg EMSX · UBS · Goldman Sachs · JP Morgan · Banca Sella ·Mediobanca· Banca Finnat· CA Indosuez · Société Générale · Intermonte

Risk Management & Compliance

Possibility of configuring all types of limits, from simple max/min exposure on asset classes up to complex limits or limits based on the target markets associated with each portfolio, with the validation of all entered transactions, monitoring the real-time exposure in order to avoid breaches.

Opportunity to create alerts (warnings) in case of approaching the limits already set, according to an editable tolerance range.

Back/Middle Office & Operations

Operations completely digitized for your administrative activities: get the maximum level of automation and efficiency with Guardian.

Possibility of benefit from the full outsourcing service of the Swiss-Rev SA back office that guarantee a punctual and reliable service, at a very competitive cost.

For each portfolio, automatic generation of trades relating to dividends, coupons, redemptions, corporate actions, option exercises according to market specifications (cash delivery, future delivery, out/in the money).

Notifications to the Supervisory and Tax Authorities

For each mandatory report, Guardian generates both an excel file for data verification and the file in the specific format required by the supervisory authority, ready to be uploaded to the dedicated portal.

Specific summary reports and verification of the determination of taxable income.

Registry management & Customer Relationship Management

Completely digital management of persons and contracts data, to ensure easy entry and search of any data or document of a client.

All sensitive information is stored in a separate and fully encrypted database.

Digital onboarding of master data and contracts

Thanks to the Guardian Web mobile application, clients can be onboarded directly from the tablet using a guided wizard, with special sections dedicated to risk profiling for MiFiD II and Anti-Money Laundering investments.

Once all the information, data and mandatory documents have been completed, it will be possible to proceed with the automatic generation of the management or consultancy contract, ready to be digitally signed by the client, using an advanced, valid and legally recognised electronic signature.

Fees, Invoicing & Profitability

Fully automated calculation of management and performance fees for each portfolio, using various configuration parameters.

Once set, Guardian will generate the invoice for each portfolio at the defined time limit. Report dedicated to portfolio profitability analysis.

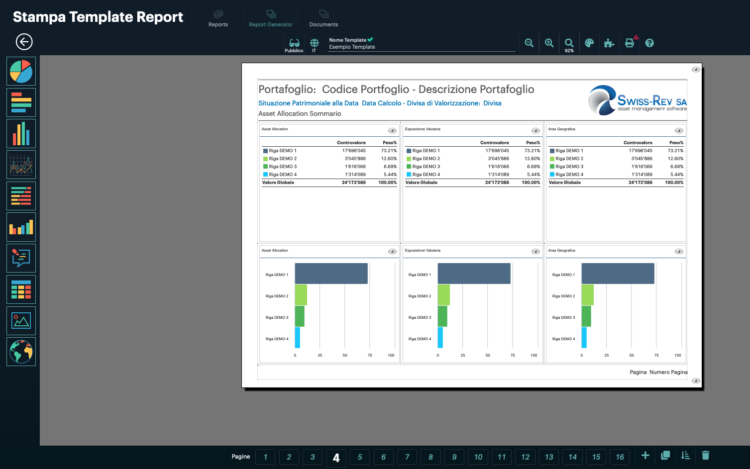

Automatic Reporting and Report Generator

Wide range of Reports available to the user, such as performance contribution reports, newsletters, market overviews, fund factsheets. All these reports are generated automatically and they can be sent to a mailing list up to five different languages, with the possibility to customise them according to specific needs.

Report generator module that allows you to create N templates and for each of them define with maximum autonomy the graphic layout and the contents you want to represent.

Web App for managers, advisors and end-users

Guardian Web allows the Front Office users (portfolio managers, promoters and advisors) and the end-clients to connect and use in real-time the software from everywhere in the world, with any kind of mobile device.

Guardian Web Demo