A unique asset management platform.

Integrated. Complete. Smart.

REQUEST A DEMO

Find out how Guardian enables your company to achieve maximum operational efficiency

Guardian Platform

Where finance gets smart

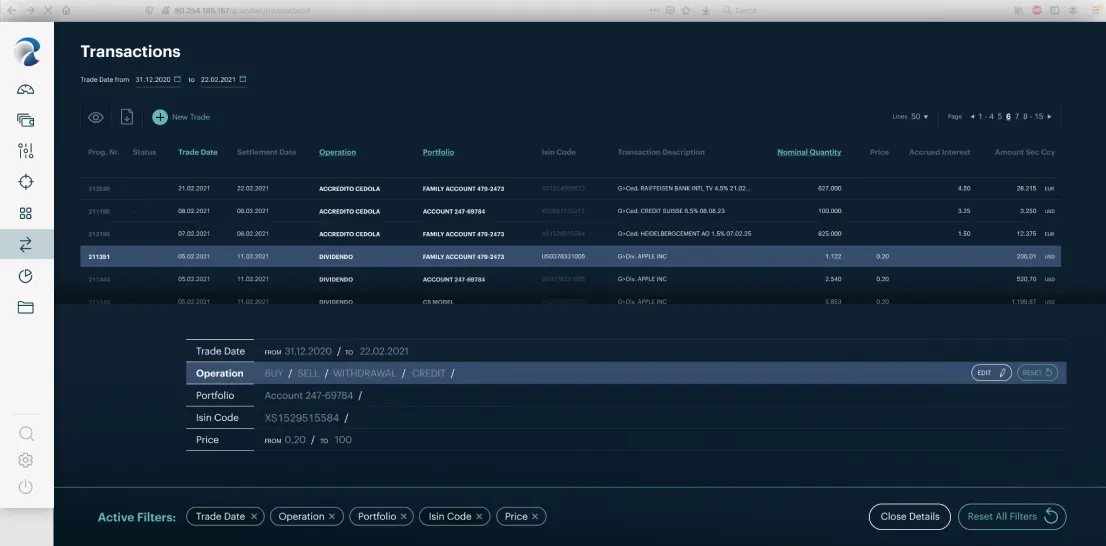

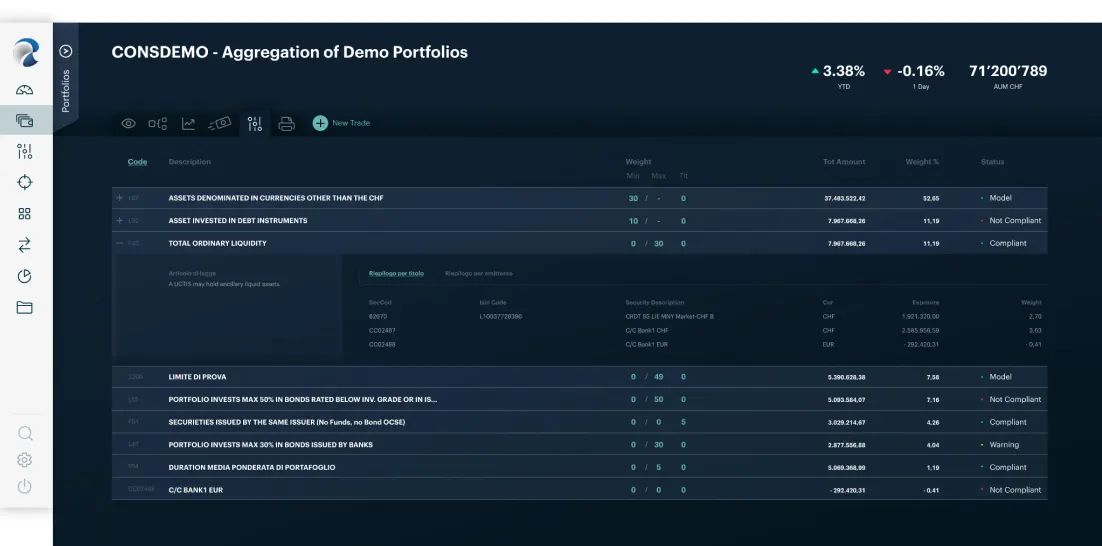

Portfolio management on various custodian banks, advanced portfolio management functions to support the management team, order routing, automated functions to support back & middle office, risk management, compliance & reporting, CRM, master data management and report generator. This is Guardian software.

Connections with custodian banks

Advanced portfolio management functions

Order routing module

Risk Management

Back Office & middle office

Compliance & automatic reporting to regulators

KYC, CRM and digital document storage

Report Generator

Technical specification

Server installation

Guardian Server is a multiplatform system (Windows Server or Linux), which can be installed in Cloud, as Software-as-a-Service (SaaS), on physical servers, at the client's IT infrastructure or in hosting.

Data security and encryption

Guardian is based on SQL database. It is possible to define different levels of access security, using VPN, OTP, double authentication factor. Sensitive information is on an encrypted database, to ensure the highest levels of security.

Interconnections

Dedicated interfaces for automatic import and processing of any flow (Swift, xls, csv,txt, Fix) received from custodian banks, brokers or other counterparties and creation of outbound flows via API/REST, SFTP or other required formats by the client.

User profiling

For each user, it is possible to define specific menu functions to be viewed, the group of portfolios that can be consulted and the relative permissions in terms of data consultation only, data entry and/or modification.

Automatic updates

New versions of the software are released occasionally and automatically via an SFTP connection between the Swiss Rev SA central server and the Guardian servers of the various clients, without any manual intervention by your IT.

Certifications

Guardian platform is periodically reviewed by leading audit companies, which have verified and certified that Guardian Platform is perfectly compliant with the European Mifid II and Swiss regulations (LSerFi/LSfin).

Multi-language application

The user can choose to interact with the software interface in English, Italian, French, German and Spanish.

Discover how we can improve your operational efficiency and client satisfaction

Request a demo

""

1